Bankruptcy Business - An Overview

Table of ContentsFacts About Bankruptcy Australia UncoveredUnknown Facts About Bankruptcy Lawyers Near Me8 Easy Facts About Bankruptcy ShownThe Only Guide to Bankruptcy AttorneyUnknown Facts About Bankruptcy Attorney Near MeThe Best Strategy To Use For Bankruptcy Business

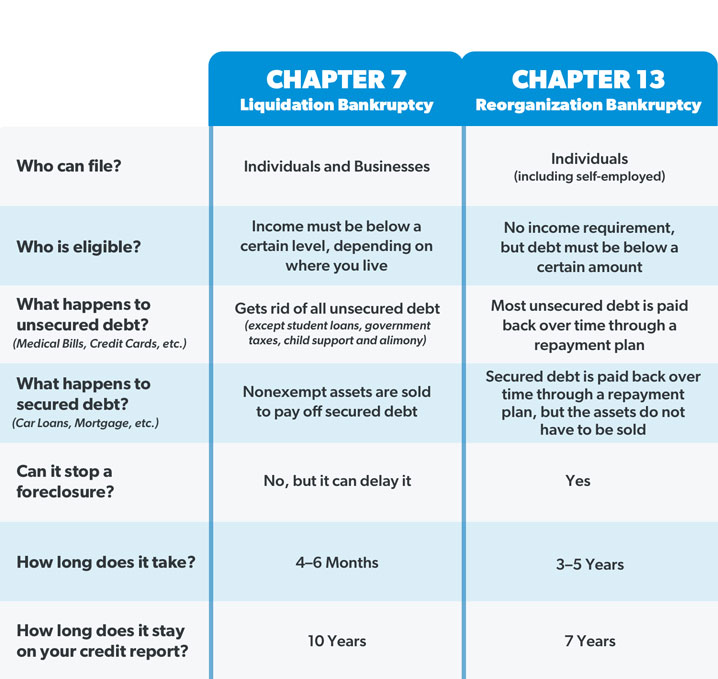

The two types of bankruptcy ease financial debt in different methods. Phase 7 personal bankruptcy, also referred to as "straight personal bankruptcy," is what many people possibly think about when they're thinking about applying for personal bankruptcy. Under this kind of bankruptcy, you'll be needed to enable a government court trustee to oversee the sale of any assets that aren't excluded (cars, occupational devices and fundamental family furnishings may be exempt).Here are some of the most common as well as essential ones:: This is the person or corporation, assigned by the bankruptcy court, to act upon behalf of the creditors. He or she examines the debtor's petition, liquidates property under Phase 7 filings, as well as distributes the earnings to creditors. In Phase 13 filings, the trustee additionally manages the borrower's payment plan, receives payments from the debtor and also disburses the money to creditors.

As soon as you've filed, you'll additionally be called for to finish a program in individual monetary management before the personal bankruptcy can be released. Under specific conditions, both needs might be waived.: When personal bankruptcy procedures are complete, the bankruptcy is thought about "released." Under Chapter 7, this occurs after your possessions have been sold and also financial institutions paid.

Some Known Factual Statements About Bankruptcy Business

The Personal bankruptcy Code calls for people who want to file Phase 7 personal bankruptcy to show that they do not have the methods to settle their debts. The requirement is planned to curtail misuse of the bankruptcy code.

If a debtor stops working to pass the means test, their Chapter 7 personal bankruptcy might either be dismissed or exchanged a Chapter 13 case. Under Phase 7 bankruptcy, you might accept proceed paying a debt that might be released in the proceedings. Reaffirming the account as well as your commitment to pay the debt is generally done to permit a debtor to maintain a piece of security, such as a vehicle, that would otherwise be confiscated as part of the personal bankruptcy proceedings.

Bankruptcies are taken into consideration negative info on your credit report, as well as can influence just how future loan providers have a peek at this website see you - bankruptcy lawyers near me. Seeing a bankruptcy on your credit data may motivate lenders to decline expanding you credit history or to use you higher interest prices and also less positive terms if they do determine to offer you credit report.

Examine This Report about Bankruptcy Lawyers Near Me

Released accounts will have their standing upgraded to mirror that they have actually been released, as well as this details will likewise appear on your credit score record. Unfavorable details on a credit history record is a variable that can hurt your credit history. Insolvency details on your credit score report might make it extremely difficult to obtain added credit history after the bankruptcy is released a minimum of until the information cycles off your credit rating record.

Research financial debt consolidation fundings to see if loan consolidation can reduce wikipedia reference the overall amount you pay as well as make your financial debt much more workable. Failing on your financial obligation is not something your lenders intend to see take place to you, either, so they may want to work with you to set up a much more attainable payment strategy.

Fascination About Bankruptcy

Checking your credit record. Developing and also adhering to a personal spending plan. Using credit in little ways (such as a safeguarded credit history card) and paying the balances in complete, right now.

Personal bankruptcy is a legal action launched when an individual or company is unable to settle superior financial obligations or obligations. The insolvency process begins with an application filed by the borrower, which is most usual, or on behalf of creditors, which is much less typical. All of the borrower's possessions are measured and examined, and the assets might be used to pay off a part of the exceptional financial debt.

Any kind of decisions in federal personal bankruptcy instances are made by an insolvency court, consisting of whether a borrower is eligible to submit and also whether they must be discharged of their financial debts.

Bankruptcy Business Fundamentals Explained

, if any, may still receive repayments, though usual stockholders will not. A housekeeping company declaring Phase 11 bankruptcy could raise its prices a little and also supply even more services to become profitable.

Not all financial obligations qualify to be released. Some of these consist of tax claims, anything that was not listed by the borrower, kid assistance or spousal support settlements, individual injury debts, and also financial obligations to bankruptcy chapter 7 the government.

Everything about Bankruptcy Benefits

When a request for insolvency has been submitted in court, creditors receive a notice and also can object if they pick to do so. If they do, they will certainly need to submit a problem in court prior to the target date. This brings about the declaring of an opponent proceeding to recuperate money owed or enforce a lien.